By Cecilia Hernandez-Cromwell for Telemundo Oklahoma (May 22, 2020). See this video news report in Spanish with English subtitles.

Taking care of loved ones can be very draining. Looking out for the ones you love should be a natural process, but in Hispanic culture it is basically mandatory. Plans need to be set with loved ones for when they can no longer look out for themselves. One of the most difficult decisions a person can make is to leave everything they have built behind to take care of relatives who can no longer take care of themselves.

“I didn’t want to leave my job; I have been working for 30 years almost my whole life. But I had to. My mom developed Alzheimer’s,” caregiver Gabriella Cervantes explained at Ciudad Su Marido con Alzheimer’s in Oklahoma City.

Since Hispanics live longer than most other groups, they tend to suffer more from cardiovascular problems and then have a higher probability of developing Alzheimer’s disease and other chronic conditions common to seniors. Life becomes difficult for anyone with this disease and for the caregivers.

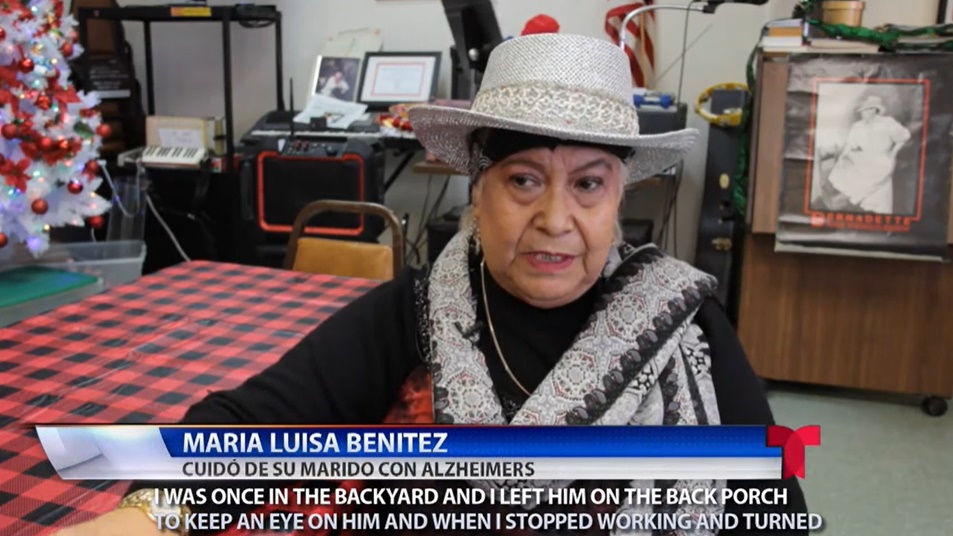

“I was once in the backyard and I left him on the back porch to keep an eye on him and when I stopped working and turned back to check on him he was gone,” said Maria Luisa Benitez in an interview at the Alzheimer’s care center.

The Alzheimer’s Association states that approximately 15.7 million people are family caregivers for someone with dementia in the United States. In a Hispanic family those caregivers aren’t nurses they are family members that become caregivers. “I would come home from work and find him dirty, he would tell me that the nurse didn’t help him at all, and then I knew I had to retire.”

In 2015, AARP said that 43.5 millions of people took care of an adult or minor without receiving any financial compensation.

Bernadette Martíne, coordinator of La Puerta de Oro, said, “A vast majority of people with Alzheimer’s get help from their children especially if they are undocumented because they do not receive a pension and no matter what their status is a lot of them live with their children or their children live with them.”

One in five (21%) of people taking care of an adult or a child are Hispanics. They are the second largest group devoting most of their time in caregiving. Family members are usually the caregivers and the financial backbone for that person.

Elder Florencio Sandoval said, “I have a pension and my oldest son gives me money when he can.”

Financial planning for the future is essential because you never know what can happen over time.

“They tell me not to worry that they would never put me in a nursing home,” said Gabriella Cervantes.

Jose Ramirez said he still has some working years left but has talked to his family about the future. “I want to retire at 60, so I can dedicate my last years to my family. I want to go back to Mexico because that is where I was born.”

In the Hispanic community, families tend to take care of their loved ones and depending where they are situated affects where they retire and stay for the rest of their lives. “If I have family here I am staying with them, but if I was here alone I would eventually make my way back to my home country,” said Jose Vera.

But while some plan their retirements others live day by day. “Life goes by as fast as the blink of an eye so how beneficial can it be to plan something that might never happen,” said Pedro Coronado

Like Alan Lakein an expert author in time management said planning is to bring your future to your present so that you can do something about it now. Therefore, take the time to talk with your parents and grandparents about their retirement.

He suggested that the conversation needs to be face-to-face with the support of other family members and you have to reassure your loved ones that your desire is not to control them but more to understand their wishes, to obtain information depending on the different situations that can occur, and to look for all the necessary documents like bank accounts and pensions etc. while continuing to talking with them to give them a change to make changes.

“It’s very good to plan, looking at your options and have consideration about the family’s feelings not just the grandparents but also the children’s and grandchildren and how each and every one of them can help,” said financial counselor Cecilia Herrera Leggett.

Remember that a planned retirement can help you in case there are any problems, such as diseases like Alzheimer’s. Having a planned retirement can help in case any life-changing situations arise such as Alzheimer’s or dementia. It can be exhausting to take care of a loved one with a life changing disease and it’s important for caregivers to know they are not alone in this. There are support groups and other resources available to you.

Cecilia Hernandez-Cromwell produced and wrote this story for Telemundo Oklahoma City, where she serves as News Director and Anchor, with the support of a journalism fellowship from the Gerontological Society of America, Journalists Network on Generations and the John A. Hartford Foundation.

The opinions expressed in this article are those of the author and do not necessarily reflect those of the Diverse Elders Coalition.